In December 2016, the annual Gross Value-Added (GVA) statistics were released for the UK regions. An indicator of economic growth, GVA is a measure of the increase in the value of the economy due to the production of goods and services. It is measured at current basic prices that includes the effect of inflation but excludes taxes (such as VAT) on products.

Not surprisingly perhaps, the headline highlighted yet again by both the press and politicians was that Wales had the lowest GVA/head figures of any of the UK regions in 2015 at £18,002. In contrast, London was nearly two and a half times higher at £43,629.

However, very few economic commentators seem to have noticed that since the recession of 2008, Wales has shown the third best growth in GVA/head after London and the South East of England, the two most prosperous parts of the UK. In fact, the Welsh economy measured in terms of GVA/head had grown by 12.9 per cent between 2008 and 2015 as compared to 11.9 per cent for the UK as a whole. Northern Ireland had the lowest increase in economic activity of any UK region at only 3.3 per cent, which suggests that, at current rates of growth, it should be overtaken by Wales in the UK prosperity league table by 2018.

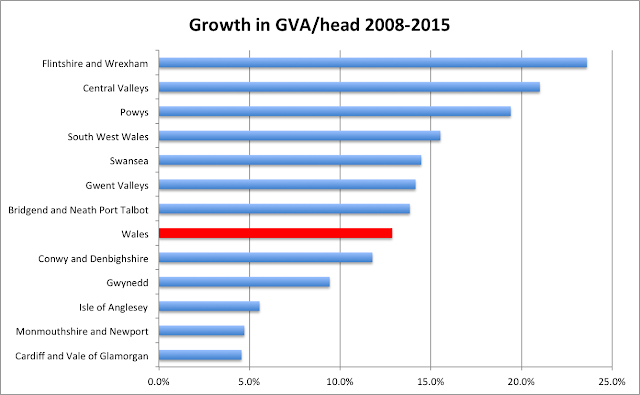

But how has the economy grown across Wales over the last eight years? Certainly, it has not been geographically even with Flintshire and Wrexham (23.6 per cent), Central South Valleys (21.0 per cent) and Powys (19.4 per cent) experiencing the biggest expansion in GVA/head since 2008.

In contrast, the lowest growth since the recession has been experienced by the most prosperous parts of Wales, namely Cardiff and the Vale of Glamorgan (4.6 per cent) and Newport and Monmouthshire (4.7 per cent) which seems to burst the popular myth that growth in Wales is focused around the capital city and surrounding areas. In fact, as these areas account for 29 per cent of the Welsh economy, it doesn’t take a genius to work out that any uplift in their performance, even to the current Welsh average, could have a significant effect on economic prosperity in the future.

In terms of the key sectors in the economy, manufacturing remains a critical industry and has shown a remarkable renaissance. Whilst it had declined to 14.5 per cent of the Welsh economy in 2008 - the lowest level recorded in modern times - it has since grown to account for 16 per cent of the economy of Wales in 2015.

In fact, during the period 2008-2015, it has expanded by 27.4 per cent, accounting for a quarter of all Welsh economic growth over this period.

In terms of a comparison with UK manufacturing, Wales has the third best performance after both the East and West Midlands with growth being double for the overall UK sector.

And with continuing investments by companies such as TVR and Aston Martin into Wales and (hopefully) stability around the Tata steel plant in Port Talbot, it should continue to develop further over the next few years.

Whilst financial and insurance activities are perceived as a major potential contributor to future prosperity by the Welsh Government, it is somewhat disappointing that the sector has only grown by 1 per cent since 2008 and makes up only 4 per cent of the Welsh economy. Even in Cardiff where an enterprise zone was established to attract more firms to the city, growth has only been 10 per cent since 2008, lower than that for the overall Welsh economy.

The Welsh tourism sector - which is largely made up of accommodation and food service activities - has grown by 24.4 per cent and whilst this is a faster expansion than the Welsh economy as a whole, it is considerably less than the growth for the UK in this sector (36.3 per cent) and is less than half of the best performing region namely the South West of England (53.3 per cent).

In terms of the public sector contribution to the Welsh economy, there remains the impression that there is an over-dependence on areas such as health, education and public administration. However, the GVA statistics show that the contribution of the public sector in Wales since 2008 has grown by only 14.7 per cent as compared to 16.3 per cent for the UK as a whole. Indeed, London has seen the largest public sector growth of 26.8 per cent.

Therefore, whilst the latest GVA statistics for Wales still show us at the bottom of the prosperity league table, there is cause for optimism for the future especially in terms of the growth of manufacturing during the last few years. This should give all of us involved in the Welsh business community some cause for optimism for 2017 and that our economy will continue to perform well in the face of some considerable challenges ahead.